What Is Risk Management?

January 30, 2020

Design | Managing the Risk Assessment | Risk Assessment | RiskWatch Blog

Risk Management Overview

Risk management is the process of identifying, assessing, and controlling risks. This is crucial to the success of an organization as it impacts decision making and influences response to different incidents. An effective risk management plan allows you to navigate an environment of uncertainty and be prepared when a negative risk is encountered. As you address risks, you should notice a positive impact on business goals, brand reputation, employee safety, etc.What Is Risk?

Now, to understand how to manage risk, it helps to have a clear definition of what risk is. Luckily, there is an international standard in risk management developed by the International Organization for Standardization (ISO). Within this, they clearly define risk as the “effect of uncertainty on objectives.” Great! We have a starting point, but what does that mean? If we unpack that rather concise definition, we can determine that risk is both uncertain, and causes an effect on something. That is, risks are intrinsically linked to objectives. At a basic level, consider the risk of an office fire; the risk only exists for your organization if you have an office and you have the objective of keeping that space safe. Without an objective, there cannot be risks. We also know that while fires happen, its uncertain what could cause it, when it could occur, or how much damage it could do. As you work through your risk management process, it will become clear how your objectives break down and relate to uncertainties.Types of Objectives

It’s necessary to understand your objectives and how you acquire them, so that you can properly dissect and manage risk. Objectives will be defined in a top-down hierarchy as you start more broadly with your goals, such as to make a profit, then get more specific such as securing an individual file. There will be a wide range of objectives from corporate, departmental, project, etc. that will have varying levels of importance.Performing a Risk Assessment

The key component of risk management is to perform risk assessments. The process is very intuitive and logical to follow, and provides valuable insight. It is fundamental that assessments are systematic, recorded, and regularly reviewed. I will break this process down into five steps.

1. Determine What You’re Trying to Achieve

As previously mentioned, a risk cannot exist if there is no objective. To manage your risks, you first have to determine your goals and what it is that you’ll be assessing. This is where you set the scope of your assessment and consider the environment. Perhaps identify a particular asset such as a facility, a system, vendor, etc.2. Find Your Risks

This is where you consider what has potential for impact on your organization. Identify any risks and which assets are affected. Determine security or compliance gaps against relevant industry standards, regulations, or best practices that may increase your exposure or vulnerability. From there, take a look and see what your unique processes or needs are that aren’t already addressed.3. Analyze Data

Once risks are identified, you’ll analyze them with custom scales and metrics that make the most sense for your business, including asset value, likelihood of the risk occurring, impact of the risk, and any third-party data. What risks have the biggest impact? Evaluate the priority of the risk compared to the resources you have available and other identified risks.4. Create Your Action Plan

Take action to mitigate risks and protect against them. Key personnel can provide information on the system, policy, task, etc. that you’re addressing. You’ll then be able to offer recommendations and assign tasks to personnel to close security gaps and improve risk scores.5. Monitor and Review

Last, you’ll measure if your actions were successful. Take note of what changed and continue to monitor at regular intervals for progress. It’s also crucial to create reports that analyze risk across your assets and track what risks were identified and what steps were taken to mitigate those risks. This makes it easier to show how risk is decreasing or compliance is improving over time as you perform your next assessment, and also to be able to provide evidence of your assessment in case of an audit.Strategies

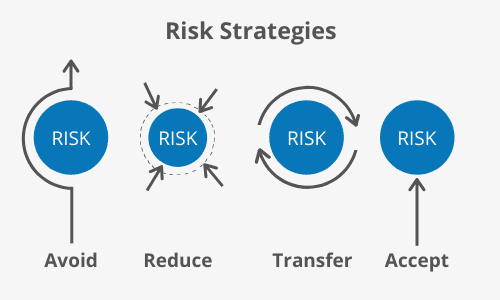

Within risk management, there are four main strategies for addressing risk. There is not one strategy that is necessarily better or worse than another; it really comes down to your industry, business objectives, and the particular risk. However, you’ll typically address each risk in the following order.

1. Avoid

The first strategy is to avoid risk. In this, first determine if a risk is worth having. Is there an old system or process in place that is not even beneficial? If so, it’s an easy decision to eliminate it, and therefore the associated risk. You can also encounter a risk that offers a lot of potential gain, but the risk is too overwhelming. In this scenario, you would discuss pros and cons internally, but may ultimately decide the potential reward of an objective is not worth the risk.2. Reduce

When completely abandoning an asset or process isn’t feasible due to its role in your organization, you’ll take steps to reduce the risk’s impact or likelihood of occurring. As an example, to reduce the likelihood of employees clicking on a phishing email, you may implement regular training classes. In the same example, to reduce impact of ransomware, you would make sure to have back up of your data.3. Transfer

In some cases, it may make sense to transfer the risk to another party. This is most commonly recognized through the use of insurance. Cyber insurance can be purchased to protect businesses from internet-based risk and property insurance can protect against damages such as theft or severe weather. In return for the transfer of particular risks, the company pays the insurance company.4. Accept

Lastly, sometimes you just accept your risk. After evaluating your risks, you may determine that some have such a low probability of occurring or nominal impact on your organization that you decide to accept them. Risk mitigation can be pricey and it isn’t always feasible to reduce risk or transfer it, and so you move forward knowing without action. As resources become available, you can revisit these risks during future assessments to see if they warrant action.Industries

If you’re wondering who needs an effective risk management plan, its you… and everyone else. Risk is a part of every industry, because its associated with every business. As we all know the potential impact of risks, the need for risk management is evident. In addition, a solid risk management plan appeals to potential vendors, investors, customers, etc. The fact that you’re also committed to regularly monitoring assets and processes ensures efficiency and consistency in business operations, which ultimately has a positive effect on your bottom line. It’s a win-win.Is it Possible to Eliminate Risk?

Yes, but not every risk. You can eliminate certain aspects of risk, such as eliminating the financial aspect of a risk by purchasing insurance or removing some commercial risk by moving a third-party process inhouse, but you will always have risk. The goal becomes keeping that risk at an acceptable level and reducing the likelihood of a risk occurring. In the case of an extreme risk, you can eliminate the activity associated with the risk and pursue alternative options to accomplishing the task. You would never want to eliminate all of you risk, because your company would never grow. Company growth stems from new ideas and processes, which often carry varying degree of risk. Innovation is required to succeed and stay competitive with industry changes and standards, so the challenge then becomes balancing how much risk is acceptable for the expected result of the change.RiskWatch for Risk Management

As we’ve covered, risk management is fairly straightforward but can be a lengthy and confusing task once you delve into the details. This is where software comes in handy, by keeping your data organized and automating key functions in your process, such as writing reports or following up with employees to make sure they complete assessments. In fact, compared to a manual process, we’ve found that our customers typically decrease their entire assessment process time by 74%. Get started today and complete your first risk assessment for free.

Subscribe for our latest posts

Recent Posts

Categories

Try any of our products, free.

Riskwatch products are easy to use, free to try, and can be customized to fit your business needs.