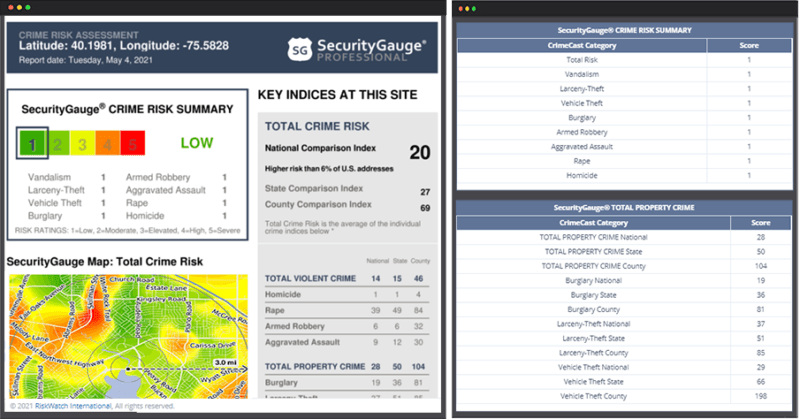

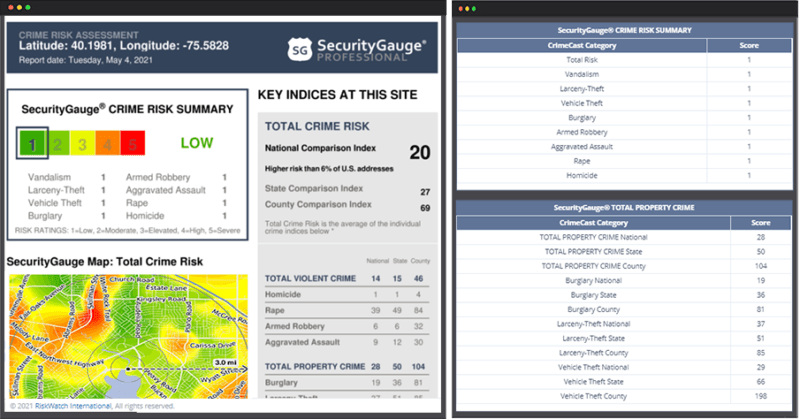

RiskWatch partners with third-party data companies to give accurate risk scoring per facility, based not only on your security assessment but also on crime data for the surrounding area as well. Data registers and third-party data providers can be used to populate new assessments with standard sets of data and determine the likelihood of an incident objectively.

PCI DSS Compliance Management Software

Streamline and Simplify PCI DSS Compliance, Meet Regulatory Requirements

Streamline PCI DSS Compliance with RiskWatch. Our Compliance assessment software offer a comprehensive approach to risk assessment and compliance management, helping organizations meet the stringent requirements of PCI DSS. From identifying and evaluating risks to implementing robust security controls, RiskWatch provides a seamless path to achieving and maintaining PCI DSS certification requirements.

Recognized For Top Rated PCI DSS Compliance Management Software

Everything you need to achieve and maintain PCI DSS Compliance

PCI DSS Compliance Automation

Streamline your PCI DSS journey with a tailored workflow, content, and reports designed specifically for the standard.

Centralized Repository

Captures responses, artifacts, and

evidence for PCI DSS controls.

Identify Security Gaps

Identifies gaps and supports the

remediation function to ensure nothing slips through the cracks.

Compliance Reporting

With RiskWatch, you’re not just compliant, you’re confidently compliant. Our automatic report generation educates your team and proves your compliance to stakeholders.

Assign and Track Tasks

Work together with your team seamlessly, share insights, and make collective decisions to manage risks effectively

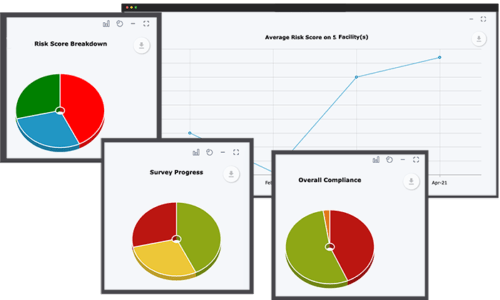

Trend Analysis

Trending analysis capabilities reuse data gathered over time and visualize your company’s PCI DSS compliance improvement each year.

Achieve your PCI DSS Goals with RiskWatch

Automated Assessments

Streamlined PCI DSS Risk Assessments

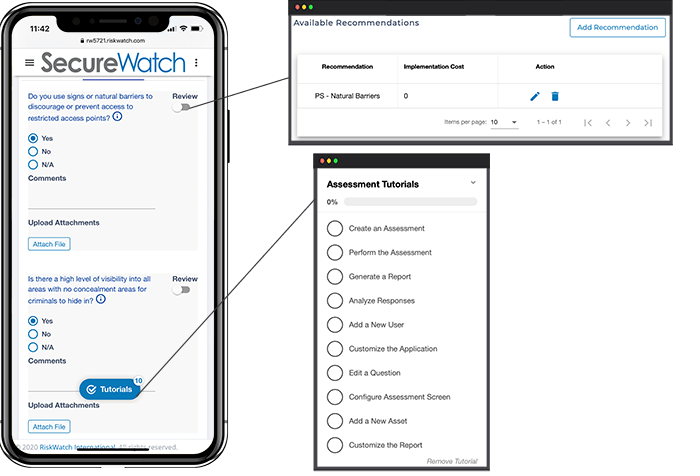

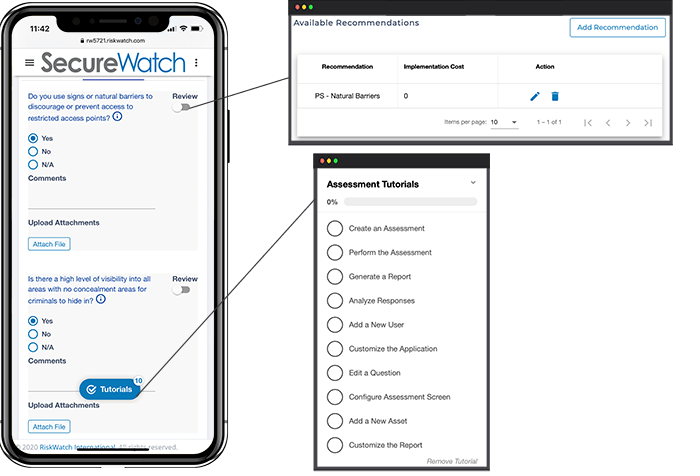

RiskWatch enables customers to complete PCI DSS assessments on the go using any browser-enabled device, even when you do not have a reliable internet connection. This ensures that data stays within a centralized location, eliminating the need to copy data manually and therefore reducing human error.

- Simplify the data entry with easy input assessment questions.

- Take any supplemental photos directly on your device and attach to your responses.

- Gathered information will be uploaded once a stable internet connection is detected.

Risk Scoring

Accurate Security Risk Scoring

- Partners include Cap Index, Security Gauge, and World Aware.

- Increase visibility and transparency with facilities, enabling more insightful decisions.

- Communicate the status of facility security to business stakeholders using a unique security risk rating for each facility.

Automated Analysis

Automated PCI DSS Analysis

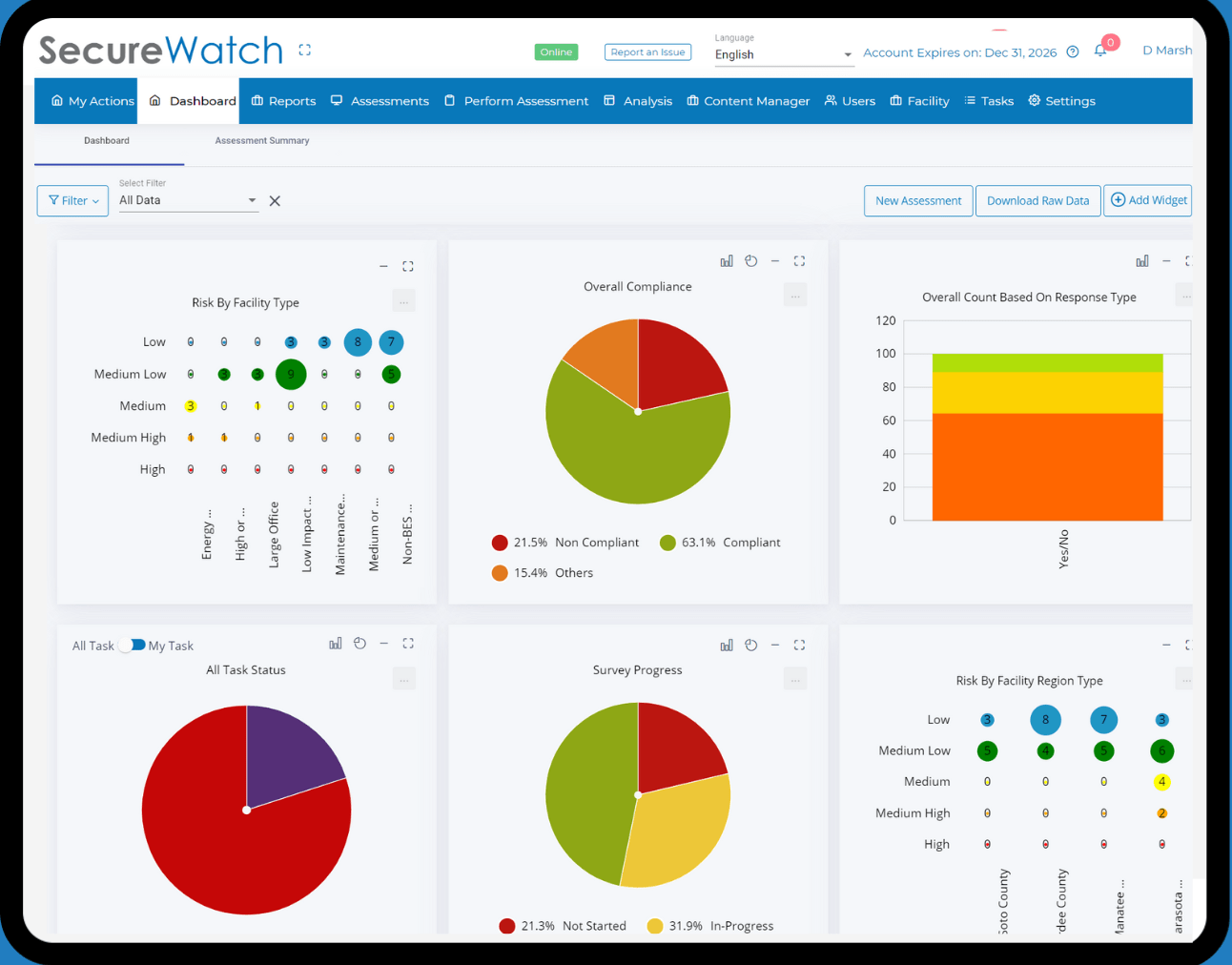

RiskWatch software streamlines the PCI DSS assessment automation, using our intelligent analysis methodology to collect all relevant security data and highlighting any security gaps. Automated analysis aims to improve security positioning without the need to manually compare site data and risk scoring prioritizes projects, allowing you to manage security without getting stuck in the weeds.

- Automatically rank sites by risk to prioritize mitigation.

- Understand security at a glance with real-time dashboard analytics.

- 80% time savings when assessments were conducted using previous assessments performed in SecureWatch and compared to a manual assessment process.

Risk Remediation

Suggested Remediation

The RiskWatch platform offers suggested remediation to instances of non-compliance to our content libraries like PCI DSS. As assessment information is collected, the platform determines if action should be taken to meet compliance. These can be shown to administrators for review or directly to team members for action.

- Immediately gain a starting point for reaching compliance with your content library

- Reduce time needed to manage your teams remedial tasks.

- Automatically assign tasks within the platform, make adjustments, or leave additional instructions.

Advanced Reporting

Automated PCI DSS Reporting

RiskWatch enables customers to standardize and automate reporting functions directly within the platform for PCI DSS compliance. Several report templates are included by default, with the added option to create custom templates. Templates can be saved to meet data and visual preferences. With the correct templates saved, generate any report with a single click.

- Save an average of 16 hours per report

- View robust data from multiple sources within a single place.

- Increase transparency with any data available in any format, on demand.

Ready to get started and automate your compliance process?

RiskWatch platform is easy to use, free to try, and can be customized to fit your business needs.

The Challenges

Payment Card Industry-Data Security Standards (PCI-DSS) are a requirement of companies that process, store, or transmit payment card data. Challenges in compliance often stem around how technical the standard is, including fields of data encryption, protection against malware, installation of security solutions, and more.

This intensive standard has over 245 requirements that must be met for an entire 12-month period to achieve certification, requiring a thorough compliance management process that grants a total view of the organization, progress on tasks, alerts to any changes, and other crucial data.

This process typically causes a lot of strain on employees that aren’t properly supported. Challenges such as missing subject matter expertise, siloed functions and disconnected systems, and monitoring progress across multiple scopes are frequent.

The Impact

Companies that don’t meet PCI-DSS compliance are at risk of experiencing a cyber-attack in which card information and other data is stolen or held for ransom. PCI-DSS non-compliance fines can range from $5,000 to $100,000 a month, a large sum for any company to waste. This is ultimately money that could instead be used to grow your organization.

Even one unmet requirement can result in a failed audit. Failed audits decrease confidence in the brand in the eyes of customers, partners, and stakeholders. Noncompliance can also result in a breach of contract, which comes with its own potential fees and loss of business that affects your bottom line. Other losses include fraud and higher subsequent costs of compliance.

Breaches or theft of personal data of cardholders will in turn affect the entire payment card environment. This lowers trust in card usage in general and makes you a negative example.

FAQs

Get answers to some of the most frequently asked questions on our PCI DSS Compliance Risk Assessment Platform.

Or head over to the Contact Us page to have a compliance expert reach out to you.

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security requirements designed to ensure all organizations that handle credit card data maintain a secure environment. It's a globally recognized standard mandated by major credit card brands like Visa, Mastercard, Discover, and American Express.

PCI DSS compliance is crucial for several reasons:

- Reduces the Risk of Data Breaches: By implementing strong security controls, you minimize the chances of hackers accessing sensitive cardholder data, protecting your business and your customers.

- Protects Your Reputation: Data breaches can severely damage your brand reputation and erode customer trust. Compliance demonstrates your commitment to data security.

- Avoids Fines and Penalties: Non-compliance can lead to hefty fines from credit card companies and potential legal action.

PCI DSS is the primary framework for cardholder data security.

PCI DSS compliance offers several benefits:

- Enhanced Customer Confidence: Customers feel more secure knowing their financial data is protected.

- Improved Operational Efficiency: Streamlined security processes can lead to better overall operational efficiency.

- Stronger Risk Management: Compliance fosters a culture of risk management, making your organization more resilient.

Riskwatch offers a comprehensive PCI DSS compliance management software solution. It automates evidence collection, streamlines audits, and provides real-time insights into your compliance posture. Here's how it helps:

- Automated Workflows: Automates tasks like collecting evidence for audits, saving time and resources.

- Continuous Monitoring: Continuously monitors your systems for vulnerabilities, ensuring proactive risk identification.

- Real-time Reporting: Provides real-time visibility into your compliance status, allowing for quick adjustments.

Automated analysis tools in Riskwatch play a vital role by:

- Reducing Manual Work: Automates time-consuming tasks like control validation and evidence collection, freeing up your team for more strategic work.

- Improving Accuracy: Automates processes to minimize human error, leading to more reliable compliance assessments.

- Boosting Efficiency: Streamlines the overall compliance process, saving valuable time and resources.

Riskwatch helps prioritize PCI DSS risk management by:

- Risk Assessment Tools: Provides tools to identify and assess risks associated with your cardholder data environment.

- Risk Scoring: Assigns risk scores based on severity and likelihood, allowing you to focus on the most critical risks first.

- Risk Categorization: Categorizes risks based on type, facilitating targeted mitigation strategies.

Riskwatch provides insights into your security status through:

- Compliance Dashboards: Offers a centralized view of your PCI DSS compliance posture with real-time data.

- Vulnerability Scans: Regularly scans your systems for vulnerabilities, highlighting potential security weaknesses.

- Gap Analysis: Identifies gaps between your current security posture and PCI DSS requirements.

Riskwatch helps reduce unnecessary costs associated with PCI DSS compliance by:

- Streamlining Workflows: Automates tasks, reducing the need for manual effort and associated labor costs.

- Improved Efficiency: Saves time and resources by streamlining the overall compliance process.

- Reduced Risk of Fines: Ensures ongoing compliance, minimizing the risk of fines for non-compliance.

Skipping PCI DSS compliance can be a big gamble. Here's what you risk:

- Fines: Credit card companies hit you hard for non-compliance.

- Data Breaches: Hackers love easy targets with weak security.

- Ruined Reputation: Customers won't trust you with their financial data.

- Business Disruption: Data breaches are a major headache to fix.

- No More Payments: Credit card companies can block you from processing transactions altogether.

- Lawsuits: Depending on the breach, you could face legal action.

Play it safe, achieve PCI DSS compliance.

Riskwatch offers a variety of features specifically designed for PCI DSS compliance, including:

- Automated Workflows: Streamline evidence collection, control validation, and gap analysis.

- Continuous Monitoring: Proactively identify vulnerabilities in your systems.

- Real-time Reporting: Gain instant insights into your compliance posture.

- Pre-Built Content Libraries: Simplify control implementation with pre-configured controls and assessments.

- Customizable Reporting: Generate reports tailored to your specific needs.

Riskwatch significantly reduces the burden of PCI DSS assessments through automation and pre-built content:

- Automated Workflows: Automates tasks like evidence collection and control testing, significantly reducing manual effort and saving your team valuable time.

- Pre-Built Controls and Assessments: Saves time by providing pre-configured templates for common PCI DSS controls. You can easily adapt these templates to your specific environment, eliminating the need to build everything from scratch.

- Customizable Templates: The platform allows you to customize templates based on your specific needs. This ensures the assessments are tailored to your environment and address your unique risks.

Pre-built content libraries in RiskWatch are libraries that contain industry standards and regulations, lending subject matter expertise and guidance for organizations.

Additional content libraries can be added in RiskWatch by choosing from custom criteria using our Bulk upload option to perform custom assessments.

Custom reports in Riskwatch allow you to generate reports tailored to your specific needs and audience. Here are some benefits:

- Stakeholder Communication: Generate reports with specific data relevant to different stakeholders, such as executives or auditors.

- Compliance Evidence: Create reports showcasing evidence collected to demonstrate compliance with PCI DSS controls.

- Targeted Analysis: Design reports to focus on specific areas of the PCI DSS standard or your risk profile.

With custom reports, you can effectively communicate your compliance posture, provide evidence for audits, and gain deeper insights into your security landscape.

Manual PCI DSS compliance is a time-consuming and error-prone process. Riskwatch offers a significant advantage over manual methods:

- Reduced Time and Effort: Automates tasks and streamlines workflows, freeing your team for other important activities.

- Improved Accuracy: Eliminates human error associated with manual data collection and control testing.

- Enhanced Visibility: Provides real-time insights into your compliance posture and facilitates data-driven decision making.

- Scalability: Easily adapts to your organization's specific needs and grows with your compliance requirements.

RiskWatch allows you to achieve and maintain PCI DSS compliance in a more efficient, reliable, and cost-effective way.

Any organization that accepts, transmits, or stores credit card data is required to comply with PCI DSS. This includes:

- Merchants: Businesses that accept credit cards for payment, such as online retailers, brick-and-mortar stores, and restaurants.

- Service Providers: Businesses that store, process, or transmit cardholder data on behalf of merchants, such as payment processors and data centers.

- Issuers: Banks and other financial institutions that issue credit cards.

Ready to get started and automate your compliance process?

RiskWatch platform is easy to use, free to try, and can be customized to fit your business needs.